The Definitive Guide to Offshore Business Registration

Table of ContentsWhat Does Offshore Business Registration Do?The Definitive Guide to Offshore Business RegistrationA Biased View of Offshore Business RegistrationThe Offshore Business Registration IdeasThe Offshore Business Registration Diaries

If a fund is signed up outside the UK, it may undergo various or lighter policy than a UK fund. It might additionally have access to a bigger variety of financial investments and monetary items. This can develop extra opportunities for producing higher returns although at the very same time it might reveal your money to higher danger.This suggests that these overseas funds reinvest development without paying tax obligation, which can boost their rate of return. This may not help you directly as a UK-based investor (as you are still taxed the exact same on any earnings), this setup can conserve cash for the fund business itself, which might pass on some of the financial savings in larger returns and/or reduced administration charges.

If the nation where you are remaining has bad financial law, you might choose financial investment funds based in even more controlled territories. Numerous people think that investing offshore is concerning paying less tax obligation.

Offshore Business Registration for Beginners

There may be an advantage if the financial investment firm itself enjoys a favourable tax obligation status (see above), as after that your investments might benefit indirectly from this if the business picks to pass on some of its savings to its consumers.

That is, your financial investments may grow quicker in a low-regulation atmosphere however just as, they might shed worth simply as greatly. Policy functions both methods, in that while it may result in slower development, it likewise provides more safeguards to you, the investor. When you invest with a fund that's registered outside the UK, you forfeit the defense offered by residential laws in favour of a various atmosphere.

The 7-Second Trick For Offshore Business Registration

This is being driven by a strong readiness to relocate in the direction of elegance, based upon an acceptance of foreign know-how in terms of items, services as well as procedures. In India, meanwhile, the substantial quantity of brand-new riches being created is fertile ground for the appropriate offering. In line with these as well as various other local patterns, the interpretation and extent of personal banking is transforming in many of these local markets together with click now it the requirement to have accessibility to a wider selection of product or services.

With greater in-house knowledge, consumers are most likely to really feel extra sustained. Consequently, the goal is to grad a bigger share of their purse. However, foreign players need to remember of a few of the difficulties their counterparts have actually encountered in certain markets, as an example India. Most of global organizations which have established a company in India have actually tried to comply with the very same design as well as style as in their residence nation - offshore business registration.

Unknown Facts About Offshore Business Registration

The majority of the wealth in India similar to many regional markets across Asia has originated from the newly-rich, who are usually in their 40s, on average. These have a tendency to be people who, 15 years back, were hardly also priority banking consumers. Better, the technical product knowledge of an international financial institution has a tendency to be repetitive in India, along with other regional markets, provided the distinctions in policy.

A winning combination, for that reason, is often a mix of a strong local player which has the client understanding and physical existence, coupled with an offshore player that brings to the table the processes and also systems to lead this. Some caution check my blog is, nevertheless, needed for offshore private banks. They will certainly often tend to have a much higher exposure have a peek at these guys to so-called tax-haven danger, provided the number of tax territories and regulations the demand to abide with.

Instead, the focus should be on business design. This implies tackling some tough inquiries, such as just how personnel are awarded; the investment development approaches; just how as well as how much consumers are charged; and whether the market usually, as well as the banks as well as their customers, are ready to transform the way they function.

Facts About Offshore Business Registration Revealed

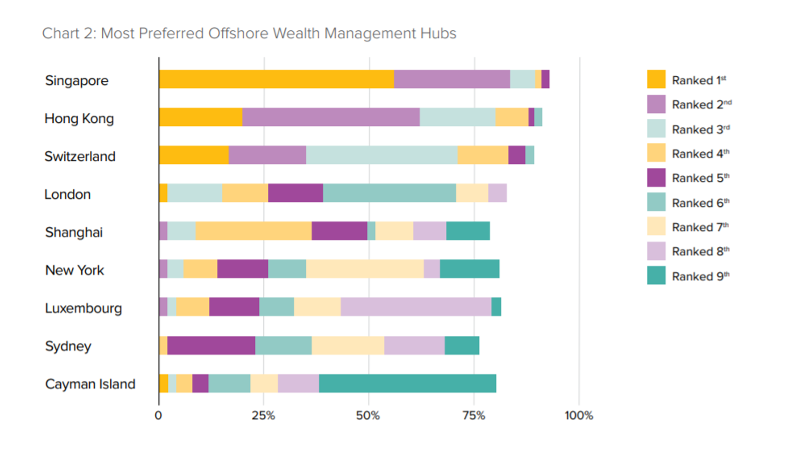

For the time being, at the very least, global private financial institutions and also wealth centers such as Singapore and Hong Kong, stay aspirational adjustment agents as trend leaders which establish the regional riches monitoring standards - offshore business registration.

Our partners are meticulously selected from amongst the leaders in their field, to offer solutions that enhance our wealth consultatory strategy and enhance your worldwide way of life.